‘Nulttwigi’ market with a sudden drop of $6,000 per day… Highest ever ticket worth $69,000

“ETF inflows greatly exceed supply… Possibility of record before halving”

US Coinbase once had a service error… “Overload as transactions rush in in an instant”

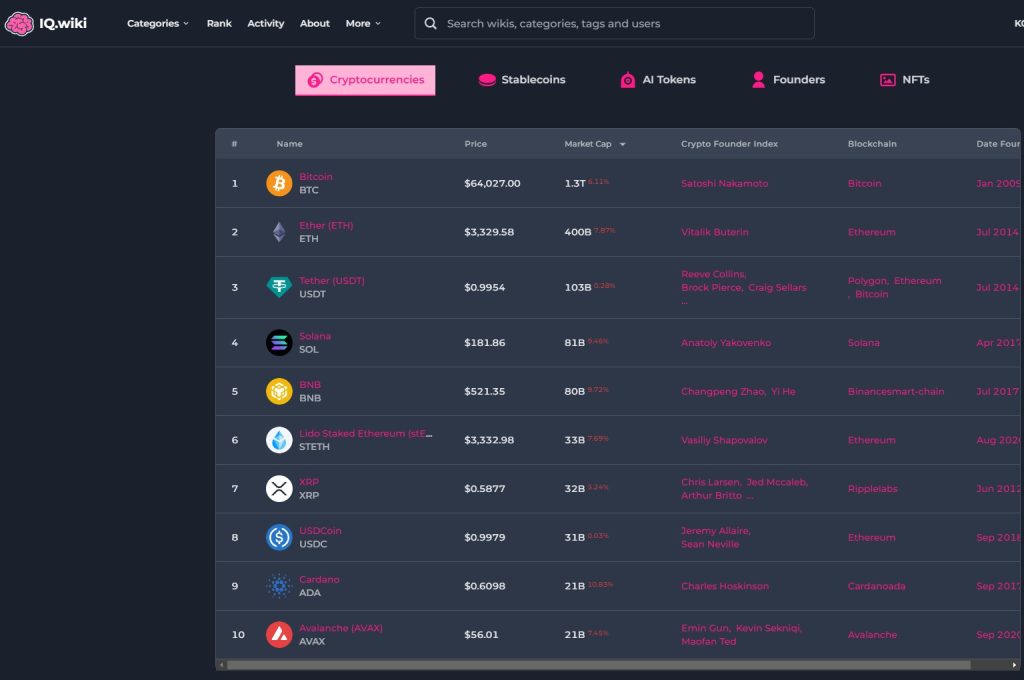

Cryptocurrency leader Bitcoin is 28 It rose sharply on the 1st (local time), exceeding the threshold of $60,000 in 27 months. At one point, it soared to the $66,000 level, and although it was a bit early, it reached a level that raised expectations of breaking the all-time high.

US virtual currency exchange Coinbase According to , as of 3:31 p.m. Eastern time on this day, the price of one Bitcoin was traded at $60,158, up 5.6% from 24 hours ago.

This is the first time since November 2021 that the Bitcoin price exceeded $60,000.

Bitcoin, which was moving in the low $57,000 range around 11 PM the previous day, jumped to the high $59,000 range in two hours and was on the verge of exceeding $66,000.

Four hours later, buying pressure came together again, breaking through the $60,000 level, and continuing this momentum, it jumped to the $66,000 level in about three hours.

The upward trend continued unabated, and at one point even reached the $64,000 range. It jumped by about $6,000, rising from the $58,000 range to the $64,000 range in one day.

Afterwards, as a large number of profits were sold due to the surge, Bitcoin showed a wild market trend on this day, falling again to the $59,000 range in just an hour and a half.

Bitcoin soared more than 20% in 16 days after exceeding the $50,000 level on the 12th. Just this month, the increase rate exceeded 40%.

Reuters It was reported that the one-month increase rate was the highest since December 2020.

As a result, Bitcoin is within sight of the $69,000 level in November 2021, which was its historical high point.

The analysis is that the Bitcoin surge is due to the continued influx of large-scale funds through the Bitcoin spot exchange-traded fund (ETF), which has been trading since the 11th, greatly exceeding the supply.

In addition, as the halving, which has been the stepping stone for the past three rallies, approaches, there are predictions that it could reach a new high this year.

Jack Pandl, head of research at Grayscale Investments, said, “Bitcoin demand is colliding with increasingly tight supply.”

He continued, “The spot Bitcoin ETF attracted an average of $195 million per day in February, while the Bitcoin network is currently producing about 900 coins per day,” adding, “The price of one Bitcoin is 6%. Assuming it is $10,000, it is about $54 million,” he explained.

He then said, “Given the upcoming Bitcoin halving in April, issuance volume will be reduced by half,” adding, “There is not enough Bitcoin to accommodate all the new demand, so the price is rising due to natural supply and demand dynamics. “He explained.

Anthony Trenchev, co-founder of virtual currency exchange Nexo, said, “As Bitcoin approaches $69,000, resistance is expected, but as it surpasses $60,000, the appetite of investors who participated in this year’s rally, especially individual investors, is rising.” “It will be able to stimulate,” he said.

Meanwhile, an error occurred in Coinbase’s trading service due to the sudden influx of buying and selling volume on this day.

Users with Coinbase accounts also posted on social media (SNS), “When I opened my account, my Bitcoin balance suddenly appeared as ‘0’.”

In response, Coinbase CEO Brian Armstrong said on his Explained.

Coinbase said, “We are aware that some users’ accounts are showing ‘0’ balances and trading errors are occurring,” and “We are currently investigating, and your assets are safe.”

p>